What we don’t | What we don't do ✘

| No “Golden Parachute” Tax Reimbursements. We do not provide any tax reimbursement payments (including “gross-ups”) on any tax liability that our NEOs might owe as a result of the application of Sections 280G or 4999 of the Internal Revenue Code (the “Code”). |

✘

| No Stock Options Granted with an Exercise Price Less Than Fair Market Value. All stock options are granted with an exercise price at the closing market price on the grant date.

|

✘

| No Special Retirement Plans. We do not offer, nor do we have plans to provide, pension arrangements, retirement plans or nonqualified deferred compensation plans or arrangements exclusively to our NEOs. |

✘

| No Special Health and Welfare Benefits. Our NEOs participate in the same company-sponsoredCompany-sponsored health and welfare benefits programs as our other full-time, salaried employees. |

✘

| No “Single Trigger” Change of ControlArrangements. No change of control payments or benefits are triggered simply by the occurrence of a change of control. All change-of-control payments and benefits are based on a “double-trigger” arrangement (that is, they either require both a change of control of the companyCompany plus a qualifying termination of employment before payments and benefits are paid or, in the case of certain performance awards, require a change of control of the companyCompany and the award is not assumed in the acquisition). |

✘

| No Hedging or Pledging. We have a policy that restricts employees from hedging our securities or pledging our securities as collateral. |

TABLE OF CONTENTS

Governance of Executive Compensation Program Role of the Compensation Committee The compensation committeeCompensation Committee discharges the responsibilities of our board of directorsBoard relating to the compensation of our NEOs. With respect to our NEOs, the compensation committeeCompensation Committee reviews and approves at the beginning of the year, or more frequently as warranted, their annual base salaries; cash bonus opportunities and cash bonus payments; long-term equity incentive

compensation; employment offers (including post-employment compensation arrangements); and other compensation, perquisites, and other personal benefits, if any. The compensation committee’sCompensation Committee’s practice of developing and maintaining compensation arrangements that are competitive includes a balance between hiring and retaining the best possible talent and maintaining a reasonable and responsible cost structure. Compensation-Setting Process We do not establish a specific target for setting the target total direct compensation opportunity of our NEOs. When determining and setting the amount of each compensation element, the compensation committeeCompensation Committee considers the following factors: •our performance against the financial and operational objectives established by the compensation committeeCompensation Committee and our board of directors;Board; •each individual NEO’s skills, experience, and qualifications relative to other similarly situated executives at the companies in our compensation peer group; •the scope of each NEO’s role compared to other similarly situated executives at the companies in our compensation peer group; •the performance of each individual NEO, based on a subjective assessment of his or her contributions to our overall performance, ability to lead his or her business unit or function, and work as part of a team, all of which reflect our core values; •compensation parity among our NEOs; •with respect to NEOs other than our CEO,Co-CEOs, the recommendations of our CEO;the Co-CEOs; and •the compensation practices of our compensation peer group and the positioning of each NEO’s compensation in a ranking of peer company compensation levels. These factors provide the framework for compensation decision-making and final decisions regarding the compensation opportunities for each NEO. Role of Management

The compensation committeeCompensation Committee believes each of our CEO,Co-CEOs, CFO, Chief LegalPeople Officer, and Administrative Officer (“CLAO”), and Chief People OfficerCLAO has valuable insight into the day-to-day contributions of our NEOs and solicits advice and input from each with respect to performance objectives under our annual bonus plan. In addition, our CFO provides input with respect to the establishment of metrics and targets for our annual incentive plan and our performance-based equity awards. Our CEOCo-CEOs also providesprovide input with respect to adjustments to annual base salaries, annual cash bonus opportunities, long-term equity incentive compensation opportunities, program structures, and other compensation-related matters for our NEOs (other than with respect to hertheir own compensation). The compensation committeeCompensation Committee reviews and discusses these recommendationsthis advice and proposalsinput, along with our CEOthe information, analysis and other advice it receives from its independent compensation consultant and uses them as one factorfactors in determining and approving the compensation for our NEOs. None of our officers is involved in decisions regarding their own compensation. Role of Compensation Consultant

The compensation committeeCompensation Committee engages an external compensation consultant to assist it by providing information, analysis, and other advice relating to our executive compensation program and the decisions resulting from its annual executive compensation review. For 2021,2023, the compensation committeeCompensation Committee retained Compensia to serve as its compensation advisor. This compensation consultant serves at the discretion of the compensation committee.Compensation Committee. TABLE OF CONTENTS

During 2021,2023, Compensia regularly attended the meetings of the compensation committeeCompensation Committee and provided the following services: •consulting with the compensation committee chairCompensation Committee Chair and other members between compensation committeeCompensation Committee meetings; •providing competitive market data based in part on the compensation peer group for our NEO positions and evaluating how the compensation we pay our NEOs compares both to our performance and to how the companies in our compensation peer group compensate their executives;

•assessing executive compensation trends within our industry, and updating on corporate governance and regulatory issues and developments; •providing competitive market data based on the compensation peer group for our board of directorsBoard and evaluating how the compensation we pay the non-employee members of our board of directorsBoard compares to how the companies in our compensation peer group compensate their boards of directors; and •reviewing market equity compensation practices, including “burn rate” and “overhang.”

In 2021,2023, Compensia did not provide any services to us other than the consulting services provided to the compensation committee.Compensation Committee. The compensation committeeCompensation Committee regularly reviews the objectivity and independence of the advice provided by its compensation consultant on executive compensation. The compensation committeeCompensation Committee has considered the six specific independence factors adopted by the SEC and reflected in the listing standards of Nasdaq and determined that the work of Compensia did not raise any conflicts of interest. Competitive Positioning

To compare our executive compensation against the competitive market, the compensation committeeCompensation Committee reviews and considers the compensation levels and practices of a group of comparable technology companies. The companies in this compensation peer group were selected on the basis of their similarity to us in size and industry focus, and geographic location.focus. For 20212023 pay decisions, the compensation committeeCompensation Committee used compensation data derived from the compensation peer group as updated in August 2020.2022. The companies in this compensation peer group were selected on the basis of their similarity to us, based on these criteria: •similar revenue size - ~0.5x to ~2.0x our last four fiscal quarter revenue of approximately $307$473 million (at the time(for Q4 of the peer group review in August 2020)2022); •similar market capitalization - ~0.3x to ~3.0x our market capitalization of $4.8approximately $4.0 billion (around the time of the peer group review in August 2020)2022); •similar revenue growth and market-capitalization to revenue ratio; •industry –- application software, internet services and infrastructure, and systems software; •executive positions similar in breadth, complexity, and/or scope of responsibility; and •competitors for executive talent. After consultation with Compensia, the compensation committeeCompensation Committee approved the following compensation peer group for 20212023 compensation decisions: | | | | | | | | |

| Alteryx | New Relic | | Everbridge

| | | Q2 Holdings

Rapid7 | Anaplan

AppFolio | PagerDuty | | Five9

| | | Qualys

Smartsheet | Appfolio

Appian | Paylocity Holding | | HubSpot

| | | Rapid7

SPS Commerce | Appian

Coupa Software | Procore Technologies | | LivePerson

| | | Smartsheet

Tenable Holdings | Avalara

Five9 | Q2 Holdings | | New Relic

| | | Varonis Systems | Cornerstone OnDemand

nCino | Qualys | | PagerDuty

| | | Workiva | Coupa Software

| | | Paylocity Holding

| | | Yext

|

To analyze the executive compensation practices of the companies in our compensation peer group, Compensia gathered data from public filings. This information is supplemented with survey data from the Radford Global Compensation Survey database of companies that are similar to us in revenue, market TABLE OF CONTENTS

capitalization and industry for purposes of providing additional perspective in the case of executive positions where the compensation peer group offered a limited number of relevant data points. This market data was then used as a reference point for the compensation committeeCompensation Committee to assess our current executive compensation levels in its deliberations on compensation forms and amounts. The market data reviewed in setting the compensation of our Co-CEOs was the average of the data shown in public filings for each peer company’s CEO and second-highest paid executive, a typical approach based on Compensia’s experience.

The compensation committeeCompensation Committee reviews our compensation peer group at least annually and adjusts its composition, taking into account changes in both our business and the businesses of the companies in the peer group.

Stockholder Advisory Votes on Named Executive Officer Compensation and Stockholder Engagement

Our stockholders have an opportunity to cast an advisory vote to approve (i) our NEOs’ compensation and (ii) the frequency of the vote to approve the NEOs’ compensation. At the 2021 annual meeting, over 95% ofcompensation (“Say-on-Frequency”). We hold the advisory votes castvote on our NEOs’ 2020 compensation voted to approveannually and there was nothe Say-on-Frequency vote on the frequencyevery six years. Our next Say-on-Frequency vote will be held in 2025. At our 2023 annual meeting, a minority of this advisory vote. We believe that the results ofour stockholders supported our compensation practices. Our Board and Compensation Committee took this vote affirm ouroutcome very seriously and was highly focused on gathering and responding to stockholders’ support of our approach to executive compensation, and therefore we have not made any significant changes tofeedback regarding our executive compensation program. Where changes have been made, they have beenpractices. Accordingly, we engaged in the direction of conforming to market practicesan extensive shareholder engagement process regarding compensation in fall 2023.

In that process, we contacted stockholders representing 70% of our compensation peer group.outstanding shares. We will consider the resultsengaged in 12 meetings with stockholders representing 33% of our outstanding shares (all stockholders who requested a meeting). The Company’s team at each of these meetings was led by our Compensation Committee Chair. In these meetings, we received important feedback from this year’sstockholders and future years’ stockholder advisory votesdescribe below how we have acted on NEO compensation when making decisions about our executive compensation program.that feedback.

| | | | | | | What we heard | How we responded | Longer Performance Periods. Many stockholders expressed a perspective that the one-year performance periods we have been using for our long-term incentive plan should instead measure performance over longer periods. | In our 2024 long-term equity incentive awards, a portion is now tied to our three-year performance as compared to an industry index. | More Disclosure. We heard that stockholders would like more information about how performance metrics for annual and long-term incentives are selected, and the rationale for changes. | In this proxy statement, we have provided more information regarding such reasoning and intend to continue providing this type of disclosure. | Long-term Incentive Metrics. Some stockholders expressed an interest in having long-term incentive metrics that are tied to the Company’s stock price performance over a three or more year period. | In our 2024 long-term equity incentive awards, 50% is now tied to our three-year TSR performance relative to an industry index. | Avoid Overlapping Metrics. Some investors indicated a preference that there not be overlap between the goals for our annual bonuses and long-term equity incentive awards. | The Compensation Committee considered this in our goal setting for 2023, but ultimately, given strategic and leadership transitions during the year, it determined that the importance of focusing on responsible growth justified the use of the same metrics in both plans for 2023. However, as discussed above, for 2024, we moved away from the use of overlapping metrics between our annual bonus and long-term equity. | Co-CEO Matters. Some stockholders asked for more information regarding the decision to implement a Co-CEO structure and how the Compensation Committee assessed the initial compensation arrangements for our Co-CEOs and how it will be assessed going forward. | In this proxy statement, we have provided more information on our reasoning underlying this and intend to continue providing this type of disclosure. |

Individual Compensation Elements

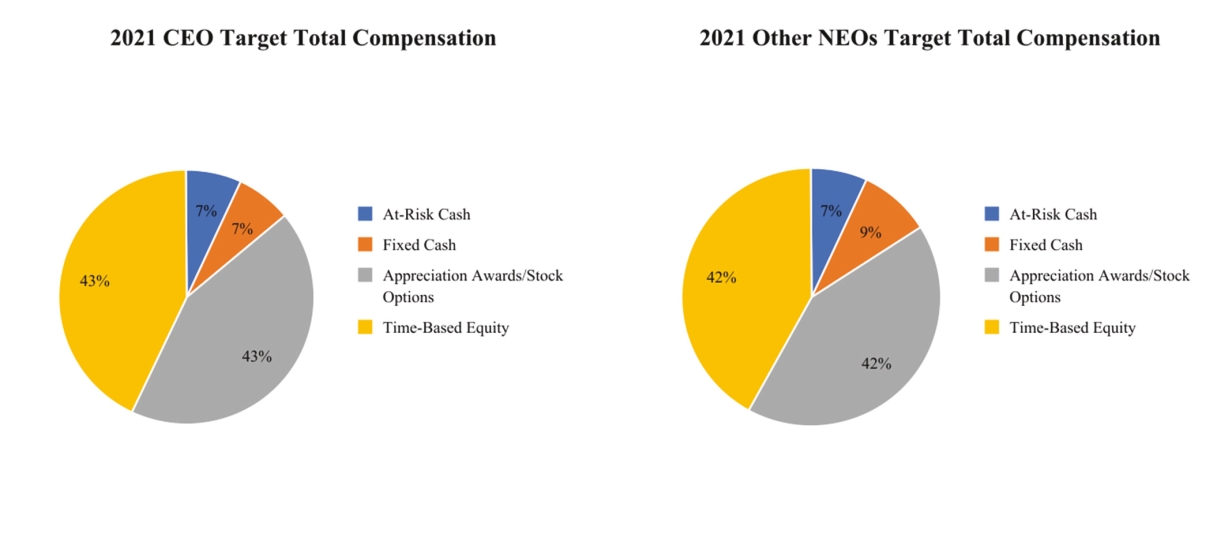

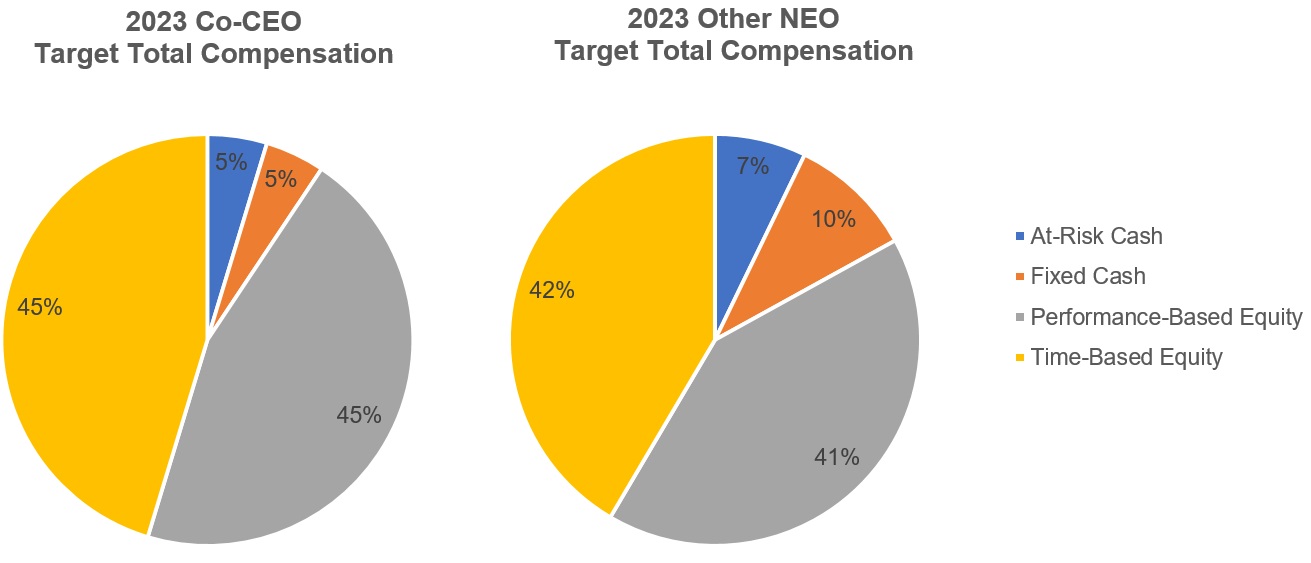

In 2021,2023, the primary elements of our executive compensation program consisted of base salary, an annual cash bonus opportunity, and long-term equity incentive compensation in the form of time-based RSU and optionPSU awards.

Base Salary

Base salary represents the fixed portion of the compensation of our NEOs and is an important element of compensation intended to attract and retain highly talented individuals. Generally, we establish the initial base salaries of our NEOs through arm’s-length negotiation at the time we hire the individual NEO, taking into account competitive market data, his or her position, qualifications, experience, prior salary level, and the base salaries of our other NEOs. Thereafter, the compensation committeeCompensation Committee reviews the base salaries of our NEOs annually and makes adjustments to base salaries as it determines to be necessary or appropriate. In December 2020, effective as of January 1, 2021, the compensation committee reviewed and approved an increase to the base salary of Mr. Huffman to $475,000 and a decrease to the base salary of Ms. Tucker to $328,000, each in connection with the CEO transition, as well as an increase to the base salary of Mr. Woodhams, in connection with his promotion to Chief Revenue Officer. In determining these adjustments, the compensation committee considered a competitive market data analysis provided by Compensia of (i) executives at comparable companies that underwent similar transitions and (ii) Executive Chair compensation, along with past and expected future contributions of each of these executives in their new roles, their prior base salary, and internal equity considerations.

In February 2021, effective as of April 1, 2021, the compensation committee reviewed the base salaries of our NEOs taking into consideration a competitive market analysis prepared by Compensia, the recommendations of our CEO, and the other factors described above.

The annual base salaries for our NEOs that were in effect as of the end of 20202022 and 2021,2023, respectively, are set forth below. Therese Tucker | | | $410,000 | | | $328,000 | | | (20.0)% | Marc Huffman | | | $385,000 | | | $475,000 | | | 23.4% | Mark Partin | | | $380,000 | | | $390,000 | | | 2.6% | Peter Hirsch | | | $360,000 | | | $375,000 | | | 4.2% | Mark Woodhams | | | $365,000 | | | $380,000 | | | 4.1% |

| | | | | | | | | | | | | | | | | | | | | | NEO | | 2022 Base Salary | | 2023 Base Salary | | Percentage Increase | | Therese Tucker | | $344,000 | | $485,000 | | 41.0%(1) | | Owen Ryan | | N/A | | $485,000 | | N/A | | Mark Partin | | $410,000 | | $430,000 | | 4.9% | | Karole Morgan-Prager | | $390,000 | | $410,000 | | 5.1% | | Mark Woodhams | | $400,000 | | $412,000 | | 3.0% |

(1) Ms. Tucker’s role expanded substantially from 2022 to 2023, which accounts for the increase in base salaryTABLE OF CONTENTS

Annual Cash BonusesBonus Opportunities

Each NEO participated in the 20212023 Bonus Plan, which was designed to motivate our NEOs to drive “top line” growth (using a revenue goal) as well as “bottom line” profitability (using a net incomenon-GAAP operating margin goal). Additionally, 20% of the Compensation Committee hasperformance under the discretionbonus plan was determined based on our performance against a set of objectives and key results that were established early in 2023 and focused on: driving responsible, profitable growth at scale; delivering valuable solutions, support, and services to determine achievementthe market; delivering experiences that customers value; and continuing our development of a discretionary component (weighted 20%), as described below.an agile, inclusive, and highly engaged workforce. Target Annual Cash Bonus Opportunities

Each NEO was assigned a target annual cash bonus opportunity for 2023, representing a percentage of his or her annual base salary. In December 2020 and effective as of January 1, 2021, the compensation committee reviewed and approved a decrease to Ms. Tucker’s percentage target annual cash bonus opportunity to 75% in connection with the CEO Transition. In determining this adjustment, the compensation committee considered the same factors it considered in making the adjustment to Ms. Tucker’s base salary as described above, as well as the impact of that adjustment. At the same time, the compensation committee reviewed and approved no change to the percentage target annual cash bonus opportunities for Mr. Huffman and Mr. Woodhams, considering the same factors it considered in making the adjustments to their base salaries in light of the CEO Transition and Mr. Woodhams’ promotion to Chief Revenue Officer, as well as the impacts of those adjustments.

In February 2021,2023, the compensation committeeCompensation Committee reviewed the target annual cash bonus opportunities of our other NEOs for 2023, taking into consideration a competitive market analysis prepared by Compensia, and the recommendations of our CEO, and theCo-CEOs (for all NEOs other factors described above. Following this review, the compensation committee did not make any changesthan our Co-CEOs). No adjustments were made to the target annual cash bonus percentagesopportunity for any of our other NEOs.

The 20212023 target annual cash bonus opportunities of the NEOs were as follows: Target Annual Cash Bonus Opportunities | | | | | | | | | | | | | | | | NEO | | 2023 Target Annual Cash Bonus Opportunity (as a percentage of base salary) | | 2023 Target Annual Cash Bonus Opportunity | | Therese Tucker | | 100% | | $485,000 | | Owen Ryan | | 100% | | $485,000(1) | | Mark Partin | | 70% | | $301,000 | | Karole Morgan-Prager | | 50% | | $205,000 | | Mark Woodhams | | 100% | | $412,000 |

Therese Tucker | | | 75% | | | $246,000 | Marc Huffman | | | 100% | | | $475,000 | Mark Partin | | | 60% | | | $234,000 | Peter Hirsch | | | 50% | | | $187,500 | Mark Woodhams | | | 100% | | | $380,000 |

(1) Mr. Ryan’s 2023 target annual cash bonus opportunity was prorated to $399,959 for his partial year of service as Co-CEO and employee of the company from March 6, 2023

Each NEO participant in the 20212023 Bonus Plan was eligible to earn from 0% to up to 125%a payment with respect to the financial portion applicable to his or her target annual cash bonus opportunity depending on our actual performance for the year as measured against the financial performance components, and additional amounts under the discretionary component of the 20212023 Bonus Plan. 2021 As described in the section “2023 Bonus Plan Performance Matrix” below, overperformance against the bonus plan components could result in payments in excess of each NEO's target opportunity, while underperformance would result in payments below that target opportunity, or in no payment being earned with respect to one or more components.

2023 Bonus Plan Performance Matrix

In February 2021,March 2023, the compensation committee,Compensation Committee, with input from management, approved revenue and net incomenon-GAAP operating margin as the performance measures for the financial component under the 20212023 Bonus Plan. The compensation committeeCompensation Committee selected these performance measures because it believed that they were appropriate drivers for our business as they provided a balance between growing our business, and managing our expenses, which enhance stockholder value over the short term.

TABLE OF CONTENTS

The 20212023 Bonus Plan was to fundbe funded based on (i) the extent of our achievement against the target level of each of the financial metrics and (ii) the discretion exercised by the compensation committeeCompensation Committee under the discretionary component, all as set forth below: Revenue

| | | Financial Component

| | | $420.6 million

| | | 50%

| Net Income

| | | Financial Component

| | | $29.4 million

| | | 30%

| Discretionary

| | | Discretionary Component

| | | —

| | | 20%

|

The revenue measure funded with respect to that performance measure as follows: 97.5% | | | 60% | 99.0% | | | 99% | 100.0% | | | 100% | 101.0% | | | 125% | 102.0% | | | 150% |

| | | | | | | | | | Percentage Achievement of 2023 Revenue target* | | Payment Percentage of

Revenue Measure* | | 98.1% | | 60% | | 100.0% | | 100% | | 104.0% | | 200% |

The net incomenon-GAAP operating margin measure funded with respect to that performance measure as follows: | | | | | | | | | | Percentage Achievement of 2023 non-GAAP Operating Margin target* | | Payment Percentage of

non-GAAP Operating Margin Measure* | | 85.4% | | 50% | | 100.0% | | 100% | | 150.0% | | 125% |

_________________ *If Revenue and Non-GAAP Operating Margin achievement during 2023 is between the percentage levels identified above, then the payment percentage with respect to the applicable performance metric is calculated based on a linear interpolation between those levels (rounded to one decimal). *

| If Revenue and Net Income achievement during 2021 is between the percentage levels identified above, then the payment percentage with respect to the applicable performance metric is calculated based on a linear interpolation between those levels (rounded to one decimal). |

For purposes of the 20212023 Bonus Plan, the financial performance measures had the following meanings: | | | | | |

| Performance Measure | | | Meaning | | Revenue | Revenue

| | | The company’s“Revenue” is defined as the sum of the Company’s subscription, support, and professional services revenue; all determined under U.S. GAAP, excluding revenue forfrom acquisitions completed during the 2021Company’s applicable fiscal year as determined in accordance with GAAP.

| year. | Non-GAAP Operating Margin | Net Income

| | | The company’s “non-GAAP net income (loss)” for the company’s 2021 fiscal year as determined in accordance with how such term“Non-GAAP Operating Margin” is defined as the Company’s Non-GAAP income from operations divided by its total Revenue.

“Non-GAAP income from operations” is defined as the Company’s GAAP income (loss) from operations, adjusted for: amortization of intangible assets, stock-based compensation, the change in the company’s annual report filed on its Form 10-K for the company’s 2021 fiscal year, including any adjustments for acquisition-related expensesfair value of contingent consideration, transaction-related costs, legal settlement gains and costs, restructuring charges, impairment charges related to any acquisition occurring duringgoodwill, impairment charges related to tangible and intangible assets, and the company’s 2021 fiscal year.costs of natural disasters. | |

Twenty percent of our 2023 Bonus Plan target is based on progress against corporate objectives and key results (OKRs) that are focused on: driving responsible, profitable growth at scale; delivering valuable solutions, support, and services to the market; delivering experiences that customers value; and continuing our development of an agile, inclusive, and highly engaged workforce. Our corporate OKRs were established in the first quarter of 2023 and our Board and

Compensation Committee review our progress against an OKR scorecard. The discretionary component was included to provideaggregate progress against OKRs for the compensation committee with flexibility to incent achievement of business goals and objectives that may evolve after the beginning of the year. The compensation committee believed that retaining discretion to fund ayear results in this portion of the 2021bonus target able to be earned, comprising from 0-20% of the total bonus opportunity.

2023 Bonus Plan irrespective of achievement of the financial component was important to reward our NEOs for achievement of these goals.Decisions 2021 Bonus Plan Decisions

In February 2022,2024, the compensation committeeCompensation Committee reviewed our overall performance for 2021,2023, including performance against the performance measures established under the 20212023 Bonus Plan. Using the 20212023 Bonus Plan performance measures, the discretion it reserved under the discretionary component, the target performance, actual performance and relative weighting were as follows: Revenue

| | | $420.6 million

| | | $425.7 million

| | | 100%

| Net Income

| | | $29.4 million

| | | $36.5 million

| | | 100%

| Discretionary

| | | —

| | | —

| | | 100%

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Measure | | Target Performance Level | | Actual Performance Level | | Per Measure Payment Percentage | | Weighted Payment Percentage | | Revenue | | $602.8 million | | $589.1 million | | —% | | —% | | Non-GAAP Operating Margin | | 8.5% | | 16.2% | | 125% | | 37.5% | | Objectives and Key Results (OKRs) | | N/A | | N/A | | 26% | | 5.2% | | Total | | | | | | | | 42.7% |

TABLE OF CONTENTS

The compensation committeeCompensation Committee determined the payment percentage under the discretionary component after assessingcorporate OKRs based on positive results with respect to increasing the outstanding contributionsnumber of premier customers, beating our NEOs in 2021 towardgoals with respect to growth and profitability, and increasing our execution on key initiatives thatservices revenue. On the other hand, our customer acquisition costs exceeded our targets, we expectslightly missed our goals with respect to have long-term benefits ondowntime, and our business and to drive stockholder value over the long-term, including strong achievements in bookings, execution on key sales, marketing, and recruitment initiatives, strong leadership of the organization during the COVID-19 pandemic and CEO Transition, and strong execution of the Rimilia acquisition.employee engagement scores were below where we targeted.

Based on this levelachievement of achievement,these financial performance measures and the 2021OKRs, the 2023 Bonus Plan was funded at 115.27%42.7% of the target amount. amount for each of our NEOs. The target annual cash bonus opportunities and the actual cash bonus payments made to the NEOs for 20212023 are as follows: | NEO | | Target Annual Cash

Bonus Opportunity | | Total

Actual

2021 Cash

Bonus

Payment | NEO | | Target Annual Cash Bonus Opportunity | | Total Actual 2023 Cash Bonus Payment | Therese Tucker | | $246,000 | | $283,555 | Therese Tucker | | $485,000 | | $207,095 | Marc Huffman | | $475,000 | | $547,514 | Owen Ryan(1) | | Owen Ryan(1) | | $485,000 | | $170,782 | Mark Partin | | $234,000 | | $269,723 | Mark Partin | | $301,000 | | $128,527 | Peter Hirsch | | $187,500 | | $216,124 | | Karole Morgan-Prager | | Karole Morgan-Prager | | $205,000 | | $87,535 | Mark Woodhams | | $380,000 | | $438,012 | Mark Woodhams | | $412,000 | | $175,924 |

(1) The target annual cash bonus opportunity for Mr. Ryan for 2023 was prorated to $399,959 for his partial year of service as Co-CEO and an employee of the Company, beginning on March 6, 2023. Long-Term Equity Compensation

The compensation committeeCompensation Committee believes long-term equity compensation is an effective means for focusing our NEOs on driving increased stockholder value over a multi-year period, providing a meaningful reward for appreciation in our stock price and long-term value creation, and motivating them to remain employed with us. In December 2020, the compensation committee approved the sizes of the equity awards for Mr. Huffman and Mr. Woodhams, in connection with Mr. Huffman’s appointment as President and CEO and Mr. Woodhams’ promotion to CRO, with approximate values of $6,000,000 and $2,000,000, respectively, with such awards to be granted in 2021 when equity awards are made to our other officers. In February 2021, the compensation committee approved the size of the 2021 equity award for Ms. Tucker, in connection with her transition from CEO to Executive Chair, with an approximate value of $5,000,000. In determining the size of the 2021 equity awards for these executives, the compensation committee considered the same factors it considered for other long-term equity award decisions, including a competitive market data analysis prepared by Compensia focusing on internal promotions, along with past and expected future contributions of each of these executives in their new roles, their existing holdings, and internal equity considerations.

Annual Long-Term Equity Awards

In February 2021 and consistent with our historical practices,March 2023, the compensation committeeCompensation Committee determined the sizes of the 20212023 equity awards for the rest of our NEOs and granted equity awards to all our NEOs in the form of 50% time-based RSU awards that are settled in shares of our common stock and 50% stock options that are exercisable for shares ofPSU awards. Ms Tucker’s and Mr. Ryan’s awards were determined in connection with establishing their employment arrangements as our common stock. TheCo-CEOs based on CEO compensation committee believed that providing an equal mix of RSUs and options was important to remain competitive withat our compensation peer companies manyand in consideration of whom usethe size of an initial equity grant that would be required to hire a similar mix. RSUs provide retention incentives for our NEOs and reward them for long-term stock price appreciation while atCEO from outside the same time providing some value even if the market price of our common stock declines. Stock options provide incentives for our NEOs to grow our business and drive value for our stockholders.Company.

As with their other elements of compensation, the compensation committeeCompensation Committee determined (or in the case of Mr. Huffman and Mr. Woodhams, considered) the amount of long-term equity incentive compensation for our other NEOs for 2023 as part of its annual compensation review and after taking into consideration a competitive market analysis, the recommendations of our CEO (except with respect to his own long-term equity compensation),Co-CEOs, each NEO’s skills, experience, and role within the organization, the outstanding equity holdings of each NEO (including the vested and unvested status of such equity holdings), the proportion of our total shares outstanding used for annual employee long-term equity compensation awards (our “burn rate”) in relation to the companies in our compensation peer group, the potential voting power dilution

to our stockholders (our “overhang”) in relation to the companies in our compensation peer group, and the other factors described above. | | | | | | | | | | | | | | | | | | | | | | NEO | | RSUs (number of shares)1 | | PSUs (number of shares)2 | | Equity Awards (Targeted Grant Value) | | Therese Tucker | | 69,880 | | 69,880 | | $10,000,000 | | Owen Ryan | | 69,880 | | 69,880 | | $10,000,000 | | Mark Partin | | 34,940 | | 34,940 | | $5,000,000 | | Karole Morgan-Prager | | 23,060 | | 23,060 | | $3,300,000 | | Mark Woodhams | | 20,970 | | 20,970 | | $3,000,000 |

(1) The number of shares was determined by dividing 50% of the targeted grant value by the 30-trading day average price ended on February 28, 2023 and rounding up to the nearest 10 shares.TABLE OF CONTENTS

In 2021,(2) The number of shares was determined by dividing 50% of the compensation committee granted equity awardstargeted grant value by the 30-trading day average price ended on February 28, 2023 and rounding up to our NEOs, the material terms of which are described below:nearest 10 shares.

Therese Tucker | | | 18,720 | | | 40,790 | | | $5,000,000 | Marc Huffman | | | 22,460 | | | 48,940 | | | $6,000,000 | Mark Partin | | | 11,230 | | | 24,470 | | | $3,000,000 | Peter Hirsch | | | 7,490 | | | 16,320 | | | $2,000,000 | Mark Woodhams | | | 7,490 | | | 16,320 | | | $2,000,000 |

(1)

| The number of shares was determined by dividing 50% of the targeted grant value by the 30 calendar day average price on February 28, 2021 and rounding to the nearest 10 shares. |

(2)

| The number of shares was determined by dividing the number of RSUs by an approximate Black-Scholes valuation factor. |

Each of the equityRSU awards listed in the table above for Ms. Tucker vests as to 50% of the shares underlying the award on each of February 20, 2022 and February 20, 2023, subject to her continued service with us through the applicable date. Each of the option awards listed in the table above for our other NEOs vests as to 25% of the shares underlying the award on February 20, 20222024 and as to 1/16th16th of the shares underlying the award each quarter thereafter, subject to the NEO’s continued service with us through the applicable date.

Each of the PSU awards listed in the table above vests as to one-third of the shares underlying the award on each of February 20, 2024, 2025 and 2026, in each case subject to the NEO’s continued service with us through the applicable date, and in each case subject to our satisfaction of applicable performance-based conditions for the calendar year preceding the vesting date. These performance goals will be determined on an annual basis. The performance goals for vesting of the PSU awards, which were eligible to vest on February 20, 2024, were determined at the time of grant, relate to our performance in 2023, and are detailed in the section “2023 PSU Performance Matrix” below.

All of these awards are subject to additional vesting acceleration as described in the “Potential Payments Upon Termination or Change of Control” section below.

2023 PSU Performance Matrix

In February 2023, the Compensation Committee, with input from management, approved revenue, annualized recurring revenue (“ARR”), and non-GAAP operating margin as the performance measures for the portion of each of the 2022 and 2023 PSUs eligible to vest on February 20, 2024. The Compensation Committee selected these performance measures because it believed that they were appropriate drivers for our business as they provided a balance between growing our business and managing our expenses, which enhance stockholder value over the short term (as noted above, we have shifted to the use of longer performance periods in our 2024 long-term incentive awards). In all cases, the revenue and non-GAAP operating margin targets and scales were designed to ensure self-funding at every point along the curve.

The portion of the 2022 and 2023 PSUs eligible to vest on February 20, 2024 was determined to be available for vesting based on the extent of our achievement against the target level of each of the financial metrics, as set forth below:

| | | | | | | | | | | | | | | | 2023 PSU Plan Performance Measure | | Target Level | | Weighting | | Revenue | | $602.8 million | | 40% | | ARR | | $627.2 million | | 30% | | Non-GAAP Operating Margin | | 8.5% | | 30% |

The portion of the 2023 PSUs scheduled to vest on February 20, 2024 that is subject to the revenue metric will be available for vesting based on attainment of that performance metric as follows with the threshold performance required for our Revenue target increased from 97.5% in 2022 to 98.1% in 2023 (based on changes to our annual operating plan). Because our threshold performance requirement was higher, we made a corresponding increase in the amount earned at the threshold. The final scale for 2023 was as follows:

| | | | | | | | | | Percentage Achievement of 2023 Revenue target* | | Percentage of Subject Award Available for Vesting* | | 98.1% | | 60% | | 100.0% | | 100% | | 104.0% and above | | 150% |

The portion of the 2023 PSUs scheduled to vest on February 20, 2024 that is subject to the ARR metric will be available for vesting based on attainment of that performance measure as follows:

| | | | | | | | | | Percentage Achievement of 2023 ARR target* | | Percentage of Subject Award Available for Vesting* | | 96.8% | | 50% | | 100.0% | | 100% | | 110.0% and above | | 150% |

The portion of the 2023 PSUs scheduled to vest on February 20, 2024 that is subject to the non-GAAP operating margin metric will be available for vesting based on attainment of that performance measure as follows:

| | | | | | | | | | Percentage Achievement of 2023 non-GAAP operating margin target* | | Percentage of Subject Award Available for Vesting* | | 85.4% | | 50% | | 100.0% | | 100% | | 150% | | 150% |

_________________ *If Revenue, ARR or non-GAAP operating margin achievement during 2023 is between the percentage levels identified above, then the payment percentage with respect to the applicable performance metric is calculated based on a linear interpolation between those levels (rounded to the nearest hundred thousand dollars).

For purposes of the portion of the 2023 PSUs scheduled to vest on February 20, 2024, the financial performance measures had the following meanings:

| | | | | | | Performance Measure | Meaning | | Revenue | “Revenue” is defined as the sum of the Company’s subscription, support, and professional services revenue; all determined under U.S. GAAP, excluding revenue from acquisitions completed during the Company’s applicable fiscal year. | | ARR | “ARR” is defined as contracted annualized recurring subscription and support revenue. ARR denominated in a currency other than USD shall be revalued using foreign exchange rates as of the balance sheet date for each quarterly reporting period. ARR shall exclude the impact of acquisitions completed during the Company’s applicable fiscal year. | | Non-GAAP Operating Margin | “Non-GAAP Operating Margin” is defined as the Company’s Non-GAAP income from operations divided by its total Revenue.

“Non-GAAP income from operations” is defined as the Company’s GAAP income (loss) from operations, adjusted for: amortization of intangible assets, stock-based compensation, the change in the fair value of contingent consideration, transaction-related costs, legal settlement gains and costs, restructuring charges, impairment charges related to goodwill, impairment charges related to tangible and intangible assets, and the costs of natural disasters. |

2023 PSU Performance Decisions

In February 2024, the Compensation Committee reviewed our overall performance for 2023, including performance against the performance measures established for 2023 under the PSU awards described above. Considering the performance measures established for those awards, the target performance, actual performance, and percent available for vesting before relative weighting were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Measure | | Target Performance Level | | Actual Performance Level | | Pre-Weighting Vesting Percentage | | Weighted Vesting Percentage | | Revenue | | $602.8 million | | $589.1 million | | —% | | —% | | ARR | | $627.2 million | | $602.0 million | | —% | | —% | | Non-GAAP Operating Margin | | 8.5% | | 16.2% | | 150% | | 45% | | Total | | | | | | | | 45% |

Based on this level of achievement, the Compensation Committee determined that, with respect to the shares eligible to vest on February 20, 2024 under the 2023 PSU awards, 45% of the target amount for each of our NEOs were eligible to vest.

The numbers of shares available for vesting on February 20, 2024 under the 2023 PSUs for each of our NEOs are as follows:

| | | | | | | | | | | | | | | | Named Executive Officer | | Target 2022 and 2023 PSUs Eligible to Vest on 2/20/2024

(Number of Shares) | | Total 2022 and 2023 PSUs Earned and Vested on 2/20/2024

(Number of shares) | | Therese Tucker | | 23,293 | | 10,481 | | Owen Ryan | | 23,293 | | 10,481 | | Mark Partin | | 22,519 | | 10,132 | | Karole Morgan-Prager | | 13,339 | | 6,001 | | Mark Woodhams | | 13,513 | | 6,080 |

Employee Benefits

Our NEOs are eligible to participate in our employee retirement benefit programs on the same basis as our other full-time, salaried employees. We sponsor a Section 401(k) profit-sharing plan, which is intended to qualify for favorable tax treatment under Section 401(a) of the Code. Our eligible U.S. employees, including the NEOs, are entitled to participate on the first day of the month following the date of hire. The Section 401(k) plan includes a salary deferral arrangement under which participants may elect to defer up to 100% of their current eligible compensation up to the statutorily prescribed limit. All participants’ interests in their deferrals are 100% vested when contributed. The Section 401(k) plan permits us to make matching contributions and profit-sharing contributions to eligible participants. In 2020,2023, we paid discretionary matching contributions that are fully vested.

In addition, our NEOs are eligible to participate in our employee welfare benefit programs on the same basis as all of our employees. These benefits include medical, dental and vision benefits, disability insurance, basic life insurance coverage, health savings accounts, and accidental death and dismemberment insurance. All NEOs, except for Ms. Tucker, are also eligible to participate in our employee stock purchase plan (ESPP)(“ESPP”).

We design our employee benefits programs to be affordable and competitive in relation to the market, as well as compliant with applicable laws and practices. We adjust our employee benefits programs as needed based upon regular monitoring of applicable laws and practices and the competitive market.

Perquisites, Special Bonuses and Other Personal Benefits

Currently, we do not view perquisites, special bonuses, or other personal benefits as a significant component of our executive compensation program. Accordingly, we do not provide perquisites, special bonuses, or other personal benefits to our NEOs, except in situations where we believe it is appropriate to assist an individual in the performance of his or her duties, to make our NEOs more efficient and effective, and for recruitment and retention purposes. Employment Arrangements

We have entered into written employment offer letters with each of our NEOs, other than Ms. Tucker and Mr. Ryan, and an employment agreement with each of Ms. Tucker.Tucker and Mr. Ryan. Each of these employment arrangements was approved on our behalf TABLE OF CONTENTS

by the compensation committeeCompensation Committee or, in certain instances, by our board of directors.Board. Each of these employment arrangements provides for “at will” employment and set forth the compensation arrangements for the NEO, including base salary and an annual cash bonus opportunity.

On March 5, 2023, in connection with Ms. Tucker’s transition to become Co-CEO, we entered into an employment agreement with Ms. Tucker, which supersedes her prior employment agreement. We entered into an employment agreement with Mr. Ryan at the same time on substantially the same terms. In connection with this transition, the Compensation Committee approved an increase to Ms. Tucker’s base salary in connection with her transition from Executive Chair to Co-CEO. In determining this adjustment, the Compensation Committee considered the substantial increase in Ms. Tucker’s duties and responsibilities as a result of this transition, and took into account a competitive market data analysis provided by Compensia.

In filling each of our executive positions, our board of directorsBoard or the compensation committee,Compensation Committee, as applicable, recognized that it would need to develop competitive compensation packages to attract qualified candidates in a dynamic labor market. At the same time, our board of directorsBoard and the compensation committeeCompensation Committee were sensitive to the need to integrate new executive officers into the executive compensation structure that we were seeking to develop, balancing both competitive and internal equity considerations.

For information on the specific terms and conditions of the employment arrangements of the NEOs, see the discussion of “Executive Employment Arrangements” below. Post-Employment Compensation

We entered into written participation agreements under our Change of Control and Severance Policy or the Policy,(the “Policy”) with each of our NEOs (other than Ms. Tucker)Tucker and Mr. Ryan) and a written employment agreement with Ms. Tucker that providesand Mr. Ryan, providing for change of control and severance payments and benefits.

On March 5, 2023, in connection with Ms. Tucker’s transition to become Co-CEO, we entered into an employment agreement providing for post-employment compensation with Ms. Tucker, which supersedes her prior employment agreement.

On March 5, 2023, in connection with Mr. Ryan’s transition to become Co-CEO, we entered into an employment agreement providing for post-employment compensation with Mr. Ryan.

We believe that having in place reasonable and competitive post-employment compensation arrangements areis essential to attracting and retaining highly qualified executive officers. Our post-employment compensation arrangements are designed to provide reasonable compensation to executive officers who leave our companyCompany under certain circumstances to facilitate their transition to new employment. Further, we seek to mitigate any potential employer liability and avoid future disputes or litigation by requiring a departing executive officer to sign a separation and release agreement acceptable to us as a condition to receiving post-employment compensation payments or benefits.

We do not consider specific amounts payable under these post-employment compensation arrangements when establishing annual compensation. We do believe, however, that these arrangements are necessary to offer compensation packages that are competitive.

We believe that these arrangements are designed to align the interests of management and stockholders when considering the long-term future for the company.Company. The primary purpose of these arrangements is to keep our most senior executive officers focused on pursuing all corporate transaction activity that is in the best interests of stockholders regardless of whether those transactions may result in their own job loss. Reasonable post-acquisition payments and benefits should serve the interests of both the executive and our investors.

All payments and benefits in the event of a change of control of the companyCompany are payable only if there is a subsequent loss of employment by an executive officer (a so-called “double-trigger” arrangement). In the case of the acceleration of vesting of outstanding equity awards, we use this double-trigger arrangement to protect against the loss of retention power following a change of control and to avoid windfalls, both of which could occur if vesting accelerated automatically as a result of the transaction.

We do not use excise tax payments (or “gross-ups”) relating to a change of control of the companyCompany and have no such obligations in place with respect to any of our NEOs. On May 12, 2021, our compensation committee conducted a periodic review of the severance and change in control protections provided to our NEOs and other officers under the Policy. Based on such review, conducted with the committee’s independent compensation consultant, Compensia, the committee made certain modifications to such protections to align them with protections provided at compensation peer companies.

For information on the change of control and severance agreements for the NEOs, as well as an estimate of the potential payments and benefits payable under these agreements as of the end of 2021,2023, see “Executive Employment Arrangements” and “Potential Payments Upon Termination or Change of Control” below.

Other Compensation Policies and Practices Policy Prohibiting Hedging or Pledging of Our Equity Securities

Our Insider Trading Compliance Policy prohibits all our employees, including our NEOs, and the members of our board of directorsBoard from engaging in derivative securities transactions, including hedging, with respect to our common stock and from pledging our securities as collateral or holding our securities in a margin account. TABLE OF CONTENTS

Executive Stock Ownership Guidelines

In February 2020, the compensation committeeCompensation Committee and the nominatingNominating and corporate governance committeeCorporate Governance Committee recommended, and our board of directorsBoard approved, stock ownership guidelines for our executive officers. Under these guidelines, each executive officer is expected to attain minimum levels of stock ownership equal to 1x (or 5x, in the case of the CEO and Executive Chair)our Co-CEOs) the executive officer’s annual base salary. For purposes of this requirement, shares countedowned outright count toward these guidelines include any shares owned outright and, prior to February 2024, when the Compensation Committee modified the methodology, the calculations included the in-the-money value of vested but unexercised stock options. The value for purposes of satisfying this requirement is the 90-day trailing average of the closing price of our common stock as of the last trading day of the fiscal year prior to the compliance date. Executive officers have a phase-in period that lasts until the later of February 2025 or, if applicable, the fifth anniversary of the date they become an executive officer or are appointed to their position to comply with these guidelines. If an executive officer does not achieve the minimum level of ownership by the executive officer’s compliance date, then 50% of the after-tax value of the executive officer’s exercised options or vested RSUs will be retained until the minimum level of ownership for the executive officer is met. As of December 31, 2021,2023, all of our executive officers had exceededwere in compliance with the currentstock ownership requirements under the guidelines. Tax and Accounting Considerations Deductibility of Executive Compensation

Section 162(m) of the Code generally limits the amount we may deduct from our federal income taxes for compensation paid to our CEO and certain other current and former executive officers that are “covered employees” within the meaning of Section 162(m) of the Code to $1 million per individual per year, subject to certain exceptions. The regulations promulgated under Section 162(m) of the Code contain a transition rule that applies to companies, such as ours, that become subject to Section 162(m) of the Code by reason of becoming publicly held. Pursuant to this rule, certain compensation granted during a transition period (which ended on the 2020 annual meeting for us) currently is not counted toward the deduction limitations of Section 162(m) of the Code if the compensation is paid under a compensation arrangement that was in existence before the effective date of the initial public offering and certain other requirements are met. While certain of our equity awards may be eligible to be excluded from our deductibility limitation of Section 162(m) of the Code pursuant to this transition rule, the compensation committeeCompensation Committee has not adopted a policy that all equity or other compensation must be deductible.

In approving the amount and form of compensation for our NEOs, in the future, the compensation committeeCompensation Committee generally considers all elements of the cost to us of providing such compensation, including the potential impact of Section 162(m) of the Code, as well as our need to maintain flexibility in compensating executive officers in a manner designed to promote our goals. The compensation committeeCompensation Committee may, in its judgment, authorize compensation payments that willmay or may not be deductible when it believes that such payments are appropriate to attract, retain or motivate executive talent. Accounting for Stock-Based Compensation

We follow the Financial Accounting Standard Board’s Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”) for our stock-based compensation awards. FASB ASC Topic 718 requires us to measure the compensation expense for all share-based payment awards made to our employees and members of our board of directors,Board, including options to purchase shares of our common stock and other stock awards, based on the grant date “fair value” of these awards. This calculation is performed for accounting purposes and reported in the executive compensation tables required by the federal securities laws, even though the recipient of the awards may never realize any value from their awards. Risk Considerations

The compensation committee,Compensation Committee, in cooperation with management, reviewed our 20212023 compensation programs. Our compensation committeeCompensation Committee believes that the mix and design of the elements of such programs do not encourage our employees to assume excessive risks and accordingly are not reasonably likely to have a material adverse effect on our company.Company. We have designed our compensation programs to be balanced so that our employees are focused on both short and long-term financial and operational performance. In particular, the weighting towards long-term equity incentive compensation discourages short-termshort-

term risk taking. Goals are appropriately set with targets that encourage growth in the business, while doing so in a manner that encourages profitability. TABLE OF CONTENTS

Executive Employment Arrangements Therese Tucker.On August 24, 2016,March 5, 2023, in connection with Ms. Tucker’s transition to Co-CEO, effective as of March 6, 2023, we entered into an employment agreement with Ms. Tucker. TheTucker, which supersedes her prior employment agreement. Under this new employment agreement has an initial term of three years from January 1, 2016 and is expected to automatically renew on each year thereafter, unless either party provides the other with at least 30 days written notice. The employment agreement automatically renewed for a one-year term on January 1, 2022. In the event of a “change in control” (as defined in Ms. Tucker’s agreement)(the “Tucker Employment Agreement”), the term will extend for an additional two years from the date of such change in control. The employment agreement providesas Co-CEO, Ms. Tucker withwill earn an initial annual base salary of $350,000$485,000 and an on-targethave a target bonus opportunity equal toof 100% of her base salary, based upon achievementsalary. The Tucker Employment Agreement also provided for equity awards that have been granted with a value of $10,000,000, which were made up of 50% RSUs that will vest over four years, subject to Ms. Tucker’s continued full-time employment, and 50% PSUs that will vest on the same performance objectivesterms as awards granted to beour other executives in 2023, as determined by our compensation committee. In connection with her transition to Executive Chair, Ms. Tucker’s salary was reduced to $328,000 and her on-target bonus opportunity was reduced to 75% of her base salary, each effective January 1, 2021.the Compensation Committee.

Ms. Tucker’s employment agreement also

The Tucker Employment Agreement provides that if her employment is terminated by us without “cause” (excluding by(as such term is defined in the Tucker Employment Agreement) other than for death or disability), we decidedisability, outside of the period beginning 3 months prior to not renew Ms. Tucker’s agreement, or Ms. Tucker resigns for “good reason”a “change of control” (as such terms areterm is defined in Ms. Tucker’s agreement),the Tucker Employment Agreement) and ending 12 months following the change of control, Ms. Tucker will receivebe eligible to receive: (i) a lump sum cash payment equal to 18 months100% of Ms. Tucker’s baseher annual salary then in effect;and (ii) a lump sum payment equal toreimbursement by the premium costsCompany for COBRA premiums Ms. Tucker pays to maintain group health insurance benefits for herself and her eligible dependents to continue health insurance coverage under COBRA for 18 months; (iii) a lump sum amount equalup to 12 months following the prorated portiondate of Ms. Tucker’s annual bonus for the year of termination that would have been paid to Ms.termination.

The Tucker had Ms. Tucker been employed by us for the entire fiscal year of termination, based on actual performance for the year (and assuming any individual performance goals would have been met at target levels); and (iv) a lump sum amount equal to the earned but unpaid bonus for the prior fiscal year, if any. Ms. Tucker’s employment agreementEmployment Agreement also provides that if her employment is terminated by us during the period beginning 3 months prior to a change of control and ending 12 months following the change of control without “cause” (excluding bycause other than for death or disability), we decide to not renew Ms. Tucker’s agreement,disability or Ms. Tuckershe resigns for “good reason” and such termination occurs in connection with, or within three months before or 24 months after a “change of control” (as such term is expected to be defined in Ms. Tucker’s agreement)the Tucker Employment Agreement), Ms. Tuckerthen she will be eligible to receive (i) a lump sum cash payment equal to 12 months150% of Ms. Tucker’s baseher annual salary, then in effect, or, if greater, as in effect immediately prior to the change of control; (ii) a lump sum cash payment equal to a prorated portion of her target annual bonus for the premium costsyear of termination and (iii) reimbursement by the Company for Ms. TuckerCOBRA premiums she pays to maintain group health insurance benefits for herself and her eligible dependents to continue health insurance coverage under COBRA for 12 months; (iii) a lump sum amount equalup to 18 months following the earned but unpaid bonus for the prior fiscal year, if any;termination date, and (iv) 100% of the shares subject to Ms. Tucker’sall of her outstanding company equity awards will vestbecome vested and to the extent applicable, become exercisable.

Ms. Tucker’s employment agreement also provides that if her employment is terminated due to her death or disability, Ms. Tucker will receive (i) a lump sum amount equal to the earned but unpaid bonus for the prior fiscal year, if any and (ii) a lump sum amount equal to the Ms. Tucker’s target bonus, pro-rated to reflect time served in the year of termination. Any receipt of severance benefits by Ms. Tucker will be contingent upon her execution and non-revocation of a separation agreement and release of claims against us. In the event anyfully exercisable effective as of the payments provided for under Ms. Tucker’s employment agreement or otherwise payable to Ms. Tucker would constitute “parachute payments” within the meaning of Section 280Glater of the Internal Revenue Codedate of 1986, as amended,termination or the Code, could be subject to the related excise tax under Section 4999date of the Code, she would be entitled to receive either full payment of benefits or such lesser amount which would result in no portionconsummation of the benefits being subjectchange of control (and with respect to any Company performance-based equity awards, for which the excise tax, whichever resultsapplicable performance period has (x) been completed as of her termination date, based on actual achievement of the applicable performance objectives or (y) not been completed as of her termination date, assuming achievement of the applicable performance objectives at target).

Owen Ryan. On March 5, 2023, in the greater amountconnection with Mr. Ryan’s transition to Co-CEO, effective as of after-tax benefits to her. Ms. Tucker’s employment agreement does not require us to provide any tax gross-up payments. Marc Huffman. WeMarch 6, 2023, we entered into an employment letteragreement on the same terms described above with Mr. Huffman in connection with his commencement of employment with us in 2018. The employment letter has no specific term and provides for “at will” employment. As of December 31, 2021, Mr. Huffman’s annual base salary was $475,000 and his annual on-target bonus opportunity was 100% of his annual base salary. The employment letter also provides Mr. Huffman with equity awards that have been previously granted and severance and change of control payments and benefits underrespect to the Policy (described below). Mr. Huffman is also reimbursed for travel in compliance with the company’s travel policy.

TABLE OF CONTENTS

Mark Partin.We entered into an employment letter with Mr. Partin. The employment letter has no specific term and provides for “at-will” employment. As of December 31, 2021,2022, Mr. Partin’s annual base salary was $390,000$410,000 and his annual on-target bonus opportunity was 60%70% of his annual base salary. Peter Hirsch.

Karole Morgan-Prager. We entered into an employment letter with Mr. Hirsch.Ms. Morgan-Prager. The employment letter has no specific term and provides for “at-will” employment. As of December 31, 2021, Mr. Hirsch’s2022, Ms. Morgan-Prager’s annual base salary was $375,000$390,000 and hisher annual on-target bonus opportunity was 50% of hisher annual base salary.

Mark Woodhams.We entered into an employment letter with Mr. Woodhams. The employment letter has no specific term and provides for “at-will” employment. As of December 31, 2021,2022, Mr. Woodhams’Woodhams' annual base salary was $380,000$400,000 and his annual on-target bonus opportunity was 100% of his annual base salary.

Marc Huffman Separation Arrangements

Effective March 2023, the Company entered into a separation agreement and release with Mr. Huffman in connection with his separation from the Company. In accordance with Mr. Huffman’s existing rights under the terms of his participation agreement under the Company’s change of control and severance policy for a termination without cause, the separation agreement provided for payment of 12 months of salary and continuation of benefits for 12 months, as well as accrued compensation through the date of his departure. In addition, to ensure a successful transition, Mr. Huffman agreed to provide certain consulting services for 12 months following the end of his employment with the Company during which time his time-based equity awards continued to vest based on the original terms of such awards and he was paid $80,000 in consulting fees. Mr. Huffman forfeited all other outstanding equity awards he held, including the retention award granted to him in December 2022.

Compensation Committee Report The compensation committeeCompensation Committee has reviewed and discussed with management the section titled “Executive Compensation” (the “Executive Compensation Disclosure”), including, without limitation, the disclosure under the heading “Compensation Discussion and Analysis,” summary executive compensation tables and related narrative information included in this proxy statement. Based on such review and discussion, the compensation committeeCompensation Committee has recommended to the board of directorsBoard that the section titled “Executive Compensation Disclosure” be included in this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.2023. Respectfully submitted by the members of the compensation committeeCompensation Committee of our board of directors:the Board:

Mika Yamamoto (Chair) Kevin Thompson Thomas Unterman (Chair)

Kevin Thompson

Sophia Velastegui

Mika YamamotoWilliam Wagner6

This compensation committeeCompensation Committee report shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A promulgated by the SEC or to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any prior or subsequent filing by BlackLine under the Securities Act of 1933, as amended, or the Securities Act, or the Exchange Act, except to the extent BlackLine specifically requests that the information be treated as “soliciting material” or specifically incorporates it by reference. 6Mr. Wagner joined our Compensation Committee in February 2024. Mr. Yoran served as a member of our Compensation Committee from January 2023 to February 2024.

Summary Compensation Table

The following table presents information concerning the total compensation of our NEOs for services rendered to us in all capacities during the years ended December 31, 2021, 2020,2023, 2022, and 2019.2021. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | Year | | Salary

($) | | Stock Awards ($)(1)(2) | | Performance Stock Awards ($)(1)(3) | | Option Awards ($)(1) | | Non-Equity Incentive Plan Compensation ($)(4) | | All Other Compensation ($)(5) | | Total ($) | Therese Tucker(6) | 2023 | | 468,833 | | | 6,286,793 | | | 1,564,591 | | | — | | | 207,095 | | | — | | | 8,527,312 | | | Co-CEO | 2022 | | 340,000 | | | 4,935,302 | | | — | | | — | | | 211,570 | | | — | | | 5,486,872 | | | 2021 | | 328,000 | | | 2,087,842 | | | — | | | 2,006,179 | | | 283,555 | | | 1,567 | | | 4,707,143 | | Owen Ryan(7) | 2023 | | 398,655 | | | 4,693,840 | | | 1,564,591 | | | — | | | 170,782 | | | 13,200 | | | 6,841,068 | | | Co-CEO | | | | | | | | | | | | | | | | Marc Huffman(8) | 2023 | | 91,025 | | | — | | | — | | | — | | | — | | | 611,674 | | | 702,699 | | Former President and Former

Chief Executive Officer | 2022 | | 493,750 | | | 4,935,302 | | | 16,020,535 | | | — | | | 410,020 | | | 12,300 | | | 21,871,907 | | | 2021 | | 475,000 | | | 2,504,964 | | | — | | | 2,505,522 | | | 547,514 | | | 13,686 | | | 6,046,686 | | | Mark Partin | 2023 | | 425,000 | | | 2,346,920 | | | 1,512,601 | | | — | | | 128,527 | | | 13,200 | | | 4,426,248 | | | Chief Financial Officer | 2022 | | 405,000 | | | 6,184,024 | | | 822,651 | | | — | | | 235,351 | | | 12,200 | | | 7,659,226 | | | 2021 | | 387,500 | | | 1,252,482 | | | — | | | 1,252,761 | | | 269,723 | | | 13,889 | | | 3,176,355 | | | Karole Morgan-Prager | 2023 | | 405,000 | | | 1,548,940 | | | 895,981 | | | — | | | 87,535 | | | 13,200 | | | 2,950,656 | | Chief Legal and

Administrative Officer | 2022 | | 385,000 | | | 3,937,668 | | | 427,706 | | | — | | | 159,908 | | | 32,552 | | | 4,942,834 | | | 2021 | | 367,500 | | | 710,446 | | | — | | | 710,086 | | | 213,242 | | | 495,437 | | | 2,496,711 | | | Mark Woodhams | 2023 | | 409,000 | | | 1,408,555 | | | 907,668 | | | — | | | 175,924 | | | 12,100 | | | 2,913,247 | | | Chief Revenue Officer | 2022 | | 391,667 | | | 3,391,807 | | | 493,530 | | | — | | | 328,016 | | | 12,200 | | | 4,617,220 | | | 2021 | | 380,000 | | | 835,360 | | | — | | | 835,515 | | | 438,012 | | | 33,723 | | | 2,522,610 | |

Therese Tucker(*)

Executive Chair | | | 2021 | | | 328,000 | | | 2,006,179 | | | 2,087,842 | | | 283,555 | | | 1,567 | | | 4,707,143 | | | | | | 2020 | | | 401,250 | | | 3,837,376 | | | 3,831,510 | | | 366,559 | | | 1,000 | | | 8,437,695 | | | | | | 2019 | | | 380,000 | | | 19,203,288 | | | 2,298,226 | | | 422,826 | | | 247,818 | | | 22,552,158 | | | 5,638,016 | Marc Huffman(*)

President and Chief Executive Officer | | | 2021 | | | 475,000 | | | 2,505,522 | | | 2,504,964 | | | 547,514 | | | 13,686 | | | 6,046,686 | | | | | | 2020 | | | 374,792 | | | 1,567,601 | | | 1,565,385 | | | 344,208 | | | 12,400 | | | 3,864,386 | | | | | | 2019 | | | 350,000 | | | 1,276,360 | | | 1,281,441 | | | 389,445 | | | 11,200 | | | 3,308,446 | | | | Mark Partin

Chief Financial

Officer | | | 2021 | | | 387,500 | | | 1,252,761 | | | 1,252,482 | | | 269,723 | | | 13,889 | | | 3,176,355 | | | | | | 2020 | | | 375,625 | | | 3,009,542 | | | 3,005,128 | | | 203,842 | | | 12,400 | | | 6,606,537 | | | | | | 2019 | | | 365,000 | | | 1,497,734 | | | 1,503,772 | | | 243,681 | | | 28,988 | | | 3,639,175 | | | | Peter Hirsch

Chief Technology Officer | | | 2021 | | | 371,250 | | | 835,515 | | | 835,360 | | | 216,124 | | | 12,600 | | | 2,270,849 | | | | | | 2020 | | | 354,167 | | | 1,178,790 | | | 1,177,037 | | | 160,928 | | | 12,498 | | | 2,883,420 | | | | Mark Woodhams

Chief Revenue Officer | | | 2021 | | | 380,000 | | | 835,515 | | | 835,360 | | | 438,012 | | | 33,723 | | | 2,522,610 | | | |

_________________ (1)The amounts in this column represent the aggregate grant date fair value of stock and option awards as computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718 or ASC 718. The assumptions used in calculating the grant date fair value of the awards reported in these columns are set forth in Note 2 to our financial statements appearing at the end of our Annual Report on Form 10-K for the year ended December 31, 2023. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. (2)The amounts reported in the Stock Awards column reflect the aggregate grant date fair value of the RSUs granted to our NEOs in fiscal 2023, 2022, and 2021. (3)The amounts reported in the Performance Stock Awards Column reflect the aggregate grant date fair value of the PSUs granted to our NEOs in fiscal 2023 and 2022, as computed in accordance with ASC Topic 718. For fiscal 2023, the estimated fair value of PSUs is calculated based on the probable outcome of the performance measures for the applicable performance period as of the date on which the PSUs were granted for accounting purposes. For PSUs approved in years prior to 2023 for which performance conditions were approved in 2023, the grant date for purposes of this disclosure is deemed to be in 2023. PSUs vest upon achievement of corporate performance goals. The assumptions used in the valuation of these awards are consistent with the valuation methodologies specified in the notes to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The grant date fair value of the fiscal 2023 PSUs assuming that the highest level of performance is achieved under the applicable performance measures is presented below. The estimated grant date fair value for these PSUs presented in the table above is different from (and lower than) the maximum value set forth below. These amounts do not necessarily correspond to the actual value recognized by our NEOs.

| (1)

| | | | | | | | | Name | | The amounts in these columns represent the aggregate grant date fair valueMaximum Value of stock and option awards as computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718, or ASC 718. The assumptions used in calculating the grant date fair value of the awards reported in this column are set forth in Note 2 to our financial statements appearing at the end of our Annual Report on Form 10-K for the year ended December 31, 2021. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions.2023 PSUs |

(2)

Therese Tucker | | The amounts in this column represent annual incentives earned under our bonus plans for the applicable fiscal year.$2,346,853 |

(3)

Owen Ryan | | In 2021, this amount consists of: (a) for Messrs.$2,346,853 | | Marc Huffman | | N/A | Mark Partin Hirsch and | | $2,268,869 | | Karole Morgan-Prager | | $1,343,937 | Mark Woodhams 401(k) plan matching contributions in the amount of $11,600 each; (b) for Mr. Woodhams, $10,000 in housing costs and $9,834 tax gross up associated with such housing costs; and (c) for all NEOs, spot bonuses provided to all Company employees and gifts provided to all attendees of our annual sales achievement event. |

(4)

| | The Total column shows the aggregate compensation for Ms. Tucker under the SEC rules. A significant portion of this total relates to a performance-based option grant made in 2016, which was recognized for accounting purposes when the performance goals were established in 2019. Although the SEC rules require the grant date fair value of this award be included in the Summary Compensation Table for 2019, at the time the accounting fair value was determined, we also determined that the Performance-Based Option was highly unlikely to be earned. Accordingly, we believe that a more representative view of Ms. Tucker’s 2019 compensation should not include the accounting value of an award made in 2016 that is highly unlikely to be earned as reflected in this “Alternate Total” column$1,361,468 |

(4)The amounts in this column represent annual incentives earned under our bonus plans for the applicable fiscal year. (5)In 2023, this amount consists of: (a) for Mr. Ryan, Mr. Partin, and Ms. Morgan-Prager, 401(k) plan matching contributions in the amount of $13,200 each and (b) for Mr. Woodhams, 401(k) plan matching contributions in the amount of $12,100. For Mr. Huffman, the amounts consist of: (a) $500,000 in severance benefits under the separation agreement and release with Mr. Huffman in connection with his separation from the Company; (b) $80,000 in payment for services provided under the consulting agreement entered into with the Company in connection with his separation; (c) $18,474 in payment for continuation of benefits in connection with his separation; and (d) $13,200 in 401(k) plan matching contribution. (6)Ms. Tucker was appointed Co-CEO of the Company on March 6, 2023. During 2023, prior to this date, Mr. Tucker served as an employee of the Company. Ms. Tucker also served as a director of the Company for all of 2023. (7)Mr. Ryan was appointed Co-CEO of the Company and became a Company employee on March 6, 2023. During 2023, Mr. Ryan served as Chair of the Board of Directors of the Company. Compensation for Mr. Ryan’s services as a Board member prior to March 6, 2023 are reflected in the Director Compensation Table above. (8)Mr. Huffman ceased to serve as our President and CEO on March 6, 2023.

Grants of Plan-Based Awards During 20212023The following table presents information regarding grants of plan-based awards made to our NEOs during 2021:2023: | | | | | Estimated Future Payouts Under Non-Equity

Incentive Plan Awards ($)(1) | | Equity Grants(2) | | | | Name | | Grant

Date | | Threshold | | Target | | Maximum | | Number of

Securities

Underlying

Restricted

Stock

Units (#) | | Number of

Securities

Underlying

Options

(#) | | Exercise

Price of

Option

Awards

($) | | Grant Date

Fair Value

of

Stock and

Option

Awards

($)(3) | | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards ($)(1) | | | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards ($)(1) | | Estimated Future Payouts Under

Equity Incentive Plan Awards | | Number of Securities Underlying Restricted Stock Units (#) | | Grant Date Fair Value of Stock and Option Awards ($)(2) | | Name Executive Officer | | Therese Tucker | | 3/6/2021 | | | | | | | | | | 40,790 | | 111.53 | | 2,006,179 | | | 3/6/2021 | | | | | | | | 18,720 | | | | | | 2,087,842 | | | N/A | | 110,700 | | 246,000 | | 307,500 | | | | | | | | |

| | | | | | | | | | | | | | | | | | Therese Tucker | | | | Therese Tucker | | | | 1/1/2023(3) | | | | 3/7/2023(3) | | | | 3/7/2023(5) | | | Owen Ryan | | | | 3/7/2023(3) | | | 3/7/2023(3) | | | | 3/7/2023(5) | | Marc Huffman | | 3/6/2021 | | | | | | | | | | 48,940 | | 111.53 | | 2,505,522 | | | 3/6/2021 | | | | | | | | 22,460 | | | | | | 2,504,964 | | | N/A | | 213,750 | | 475,000 | | 593,750 | | | | | | | | |

| | | | | | | | | | | | | | | | | Mark Partin | | 3/6/2021 | | | | | | | | | | 24,470 | | 111.53 | | 1,252,761 | | | 3/6/2021 | | | | | | | | 11,230 | | | | | | 1,252,482 | | | N/A | | 105,300 | | 234,000 | | 292,500 | | | | | | | | |